Coffee Commodity Pricing is high!

The Coffee C Contract is the commodity future whose price benchmarks the global coffee market [1]. It’s running around 3.84 USD per pound right now. One way to think about that price is the generic coffee price that providers who make instant coffee, Keurig pods and Starbucks pay.

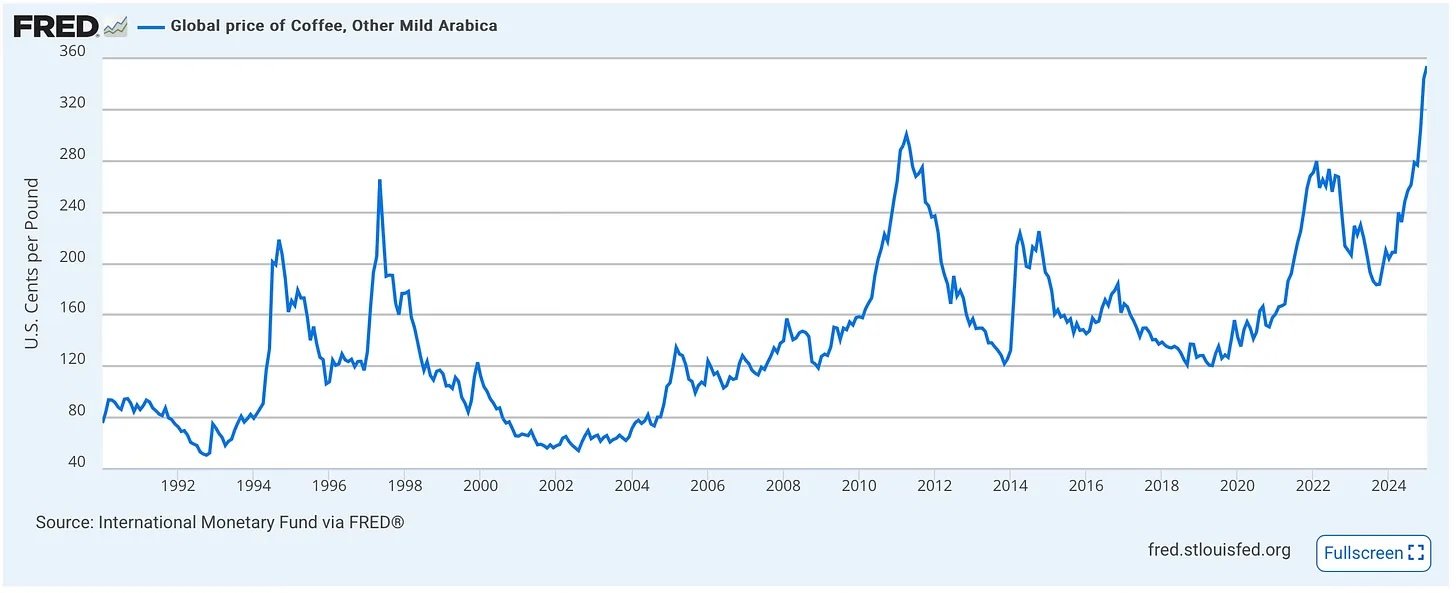

That’s the highest it’s been, for months we’ve been at levels not seen April of 1977, where it topped out around 3.23 USD per pound. For a broader context, you can check out the price of beans over the past few decades

This is all to convince you that the baseline price of coffee is going up dramatically. Last summer the index was around 2.75 USD per pound.

As of now my supplier’s prices haven’t changed much. Mostly this is due to the fact that I buy high quality - and hence higher priced - microlot coffees from craft roasters. Hence the light roasts are somewhat inelastic to the commodity price.

Of course, coffee beans aren’t sold in a vacuum. This price will impact big coffee businesses whose purchasing habits tend to affect other products that we all rely on: transportation, cups, sleeves, filters, etc. We’re tracking these secondary effects too.

Of greater concern is why the C contract price is rising. The market is finally recovering from the demand shock of COVID [2], but now suffering a supply issue - shocked most recently by drought in Brazil - induced by the deforestation and the associated effects of climate change.

That sort of structural change must eventually impact speciality coffee roasters - and hence our wholesale partners - but there is also further specialization happeningwithin this sector of the coffee industry, which could mitigate some of that pricing increase.

Let’s all just take this one day at a time.

For arabica beans at least, nowadays you can also get robusta beans delivered, for example by Nguyen Coffee Supply. While generally lower, their commodity prices have also experienced a similar rise.

In the background there is also an increase of demand coming from China.